Is Paying Off Your Home Early In Your Best Financial Interests?

Many high net worth, high income homeowners have raised the question of whether to pay off their home earlier than the loan provisions dictate. These clients express a desire to maximize their tax deductions, reduce their liability exposure while also growing their net worth with a low degree of market risk…if this sounds good to you, read on.

One tenet of Mosaic’s financial planning practice is to help clients grow their net worth in a tax efficient manner while minimizing their exposure to litigation.

What if we were able to demonstrate a strategy which provides the best of all worlds: maximizing tax benefits, minimizing litigation exposure, paying off the mortgage, maintaining liquidity and growing your worth? Are you interested yet? If not, you should be.

HIGH RISK PROTECTION

Because of your specialized career, your income and your potential for lawsuit are greater; therefore your strategy should be different. Another variable to consider with home debt is the sensibility in paying off the loan at an accelerated rate. For example, what if your desire was to pay off the home loan in 15 years as opposed to thirty?

Again, there isn’t anything wrong with this strategy; however we encourage clients to look at this decision from a different perspective. What if you were still able to pay off your home in 15 years, while also growing your wealth, maximizing your tax deduction, and lessening the impact of would-be creditors?

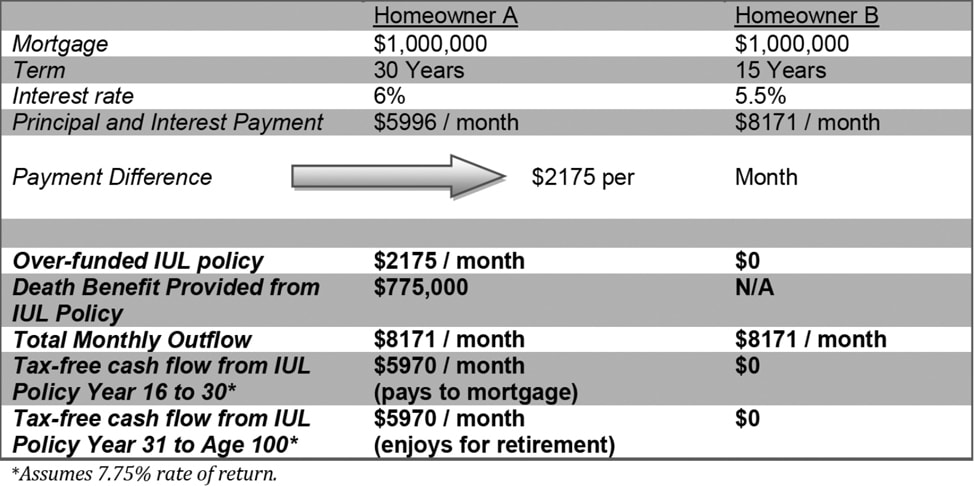

The following table illustrates the strategy of selecting a thirty year loan but taking the difference of fifteen and thirty year payments to an Equity Indexed Universal Life Insurance Policy.

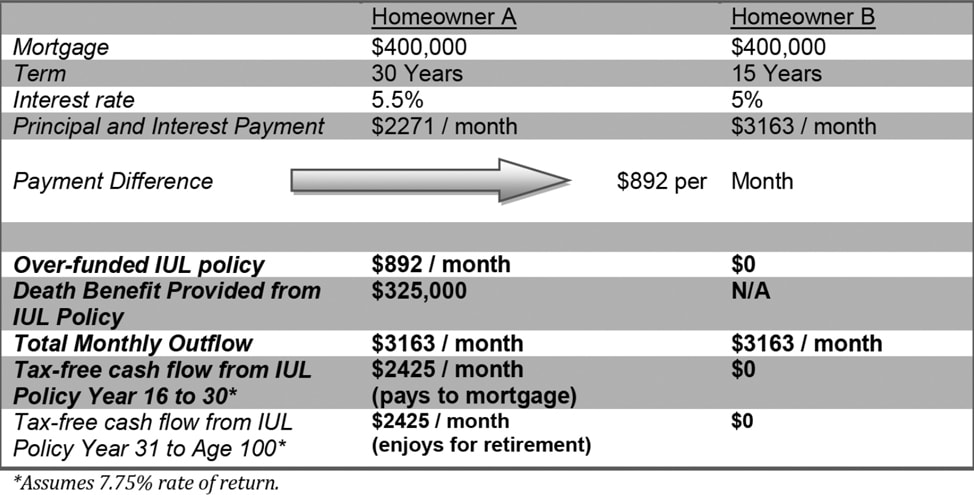

THE BENEFITS OF “EXTRA”

Another way to evaluate the financial sensibility of paying down your home more quickly is to consider the following. What if you were considering the decision of paying ‘extra’ on a monthly basis to your home in an effort to pay it off sooner? The following table illustrates the outcome to your wealth over a thirty year time frame by taking that ‘extra’ money and placing it in a side-fund, rather than the home. The parameters of this example are a male age 35, the best rating classification for the Indexed Universal Life policy, with a variable loan rate of 6.5%.

As these tables illustrate, the same end goal of early home payoff can be accomplished with vastly different results. Homeowner A not only enjoys an improved net worth, they also are in a position of additional flexibility should cash flow change.

As you are able to see, not only is your home paid off, but you’ve maximized your tax deduction via the interest on the loan. Depending on the state in which you live, you may also lessen your home’s exposure to creditors or litigation. Further, you maintain access to your money, and have grown your wealth providing tax free money, and of course, you are protecting your family in the event of your death.

Let’s start with the basic question: Should you pay off the mortgage early? Your best assumption is that the return on paying off your mortgage is the same as your mortgage rate. If you are paying 5.91% on your mortgage, the current national average, then you’re saving 5.91% interest on your principal over the term of the loan. This basic rule comes with many caveats.

TAXES

If you pay off your mortgage, you’ll lose the mortgage deduction on your federal income taxes. That lowers your overall return from repaying the mortgage. (Taxes also lower the return from most other investments.)

More importantly, the mortgage interest deduction, either by itself or with other deductions, is typically more than the standard deduction on your federal income taxes. Of all the people who itemized in 2003, 82% claimed mortgage interest as a deduction. Unless you’re a real saint, it’s probably your mortgage that allows you to itemize deductions and pay less in taxes.

LEVERAGE

If you pay off your mortgage, you’ll also lose the advantage of using someone else’s money to invest. Let’s say that your mortgage is paid off, and your home gains 5% in price this year, to $210,000 from $200,000. You’ve gained $10,000.

But let’s say you had $20,000 in equity in your home and a $180,000 mortgage. If you were to sell your home for $210,000, you’d repay the $180,000 loan, keep the $20,000 in equity and pocket $10,000 — without tying up $200,000 of your own money.

LIQUIDITY

If you suddenly need money, you may not be able to sell your house quickly.You’ll also have to pay a broker’s commission to do so. True, you can tap a home equity line of credit — but then you’re back where you started before you paid off your mortgage.

But to really make the decision, you have to compare your return with another investment. Over long periods of time, you could probably beat 5.91% by investing in stocks. The stock market has averaged a 10.4% gain since 1926, according to Ibbotson Associates, a Chicago research firm.

TIMING

When should you pay off your mortgage? If you’re close to retirement, the mortgage is near its end, and your alternatives are low-yielding bonds or bank CDs. For a retiree on a fixed income, losing a major expense means a big boost in lifestyle.

The Chicago Federal Reserve Board shows that a significant number of households can perform a tax arbitrage by cutting back on their additional mortgage payments and increasing their contribution to tax deferred accounts (TDA).

Using data from the Survey of Consumer Finances, we show that about 38% of U.S. households are accelerating their mortgage payments instead of saving in tax-deferred accounts. In the aggregate, these re-allocated savings could be costing U.S. households as much as $1.5 billion per year.

It is wise to begin this discussion as it pertains to your own home and mortgage. If you would like to learn more about this subject or receive a free quote then please contact us and we’ll be happy to help.

By Marcus E. Ortega, ChFC, RFC | Investment Advisor Representative | CEO of Mosaic Financial Associates & Orthopaedist Advisory Group | Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.