Anticipating Inflation?

For the 12 months ending in December 2016, inflation (measured by the Consumer Price Index, or CPI) increased 2.1%, the fastest pace since June 2014. Inflation stalled in 2015, rising just 0.7%. Headline CPI is a broad and closely watched measure of price changes across the U.S. economy.1

The inflation rate is still well below long-term averages, but even moderate inflation can have a negative impact on the purchasing power of fixed-income investments. For example, a hypothetical investment earning 5% annually would have a “real return” of only 3% during a period of 2% annual inflation. This rate of return might be further reduced by income taxes.

Of course, if inflation picks up speed, it could become a more pressing concern for consumers and investors. One way to help hedge your bond portfolio against a potential spike in inflation is by investing in Treasury inflation-protected securities (TIPS).

How TIPS Fight Inflation

TIPS are sold in $100 increments and are available in maturities of 5, 10, and 30 years. The principal is automatically adjusted twice a year to match any increases or decreases in the Consumer Price Index. If the CPI moves up or down, the Treasury recalculates your principal to reflect the change.

A fixed rate of interest is paid twice a year based on the current principal, so the amount of interest may also fluctuate. Thus, you are trading the certainty of knowing exactly how much interest you’ll receive for the assurance that your investment will maintain its purchasing power over time.

TIPS are guaranteed by the federal government as to the timely payment of principal and interest. If you hold these securities to maturity, you will receive the greater of the inflation-adjusted principal or the amount of your original investment; this provides the benefit of keeping up with inflation while protecting against deflation. Considering that there has been some inflation every year over the past 60 years, the principal of TIPS held to maturity is likely to be higher than when it was purchased.2

Pricing-In Protection

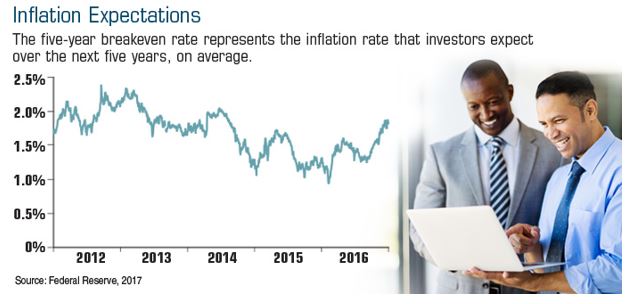

TIPS pay lower interest rates than equivalent Treasury securities that don’t adjust for inflation. The breakeven inflation rate is the difference between the yield of nominal bonds and inflation-linked bonds with similar maturities. It is the cost for inflation protection and a market-based measure of expected inflation. If inflation runs higher than expected, TIPS will earn a better return than Treasury bonds. If the inflation rate runs below the breakeven rate, then TIPS have no advantage.

Like all bonds, the return and principal value of TIPS on the secondary market will vary with market conditions. They are also sensitive to movements in interest rates. When interest rates rise, the value of existing TIPS will typically fall on the secondary market. Because headline CPI includes food and energy prices, TIPS can also be affected — for better or worse — by volatile oil prices. However, changing rates and secondary-market values should not affect the principal of TIPS held to maturity.

Keep in mind that you must pay federal income tax each year on the interest income from TIPS plus any increase in principal, even though you won’t receive that money until they mature. For this reason, many investors prefer to hold TIPS in a tax-deferred account such as an IRA.

1–2) U.S. Bureau of Labor Statistics, 2017 (data through December 2016)

This information is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor

© 2017 Broadridge Investor Communication Solutions, Inc.

Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.