A Reminder on the Big Moves: It’s the % (Not the Points) That Counts

The Dow Jones Industrial Average (the Dow or DJIA) dropped by 1,000 points on February 24, notching the third-largest ever daily point decline. Rising fears about the ultimate effects of the coronavirus and its impact on the global economy have investors worried.

But a 1000-point move on the Dow at today’s values equates to a drop in value of about 3.5%. While nobody wants to lose 3.5% of their investments (especially in a single day), a headline that shows a 3.5% loss looks far less alarming than one that screams about a 1,000-point drop.

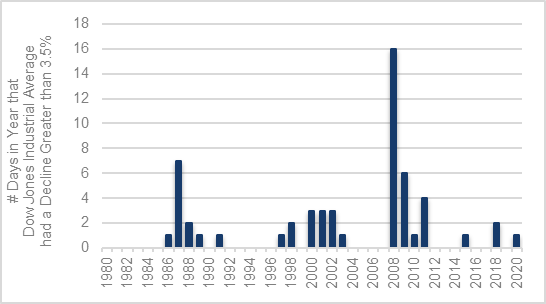

While that large down day ranks with the top 1% in terms of large historical moves in the Dow, such moves have occurred once or twice a year, on average, over the last 40 years. (Exhibit 1).

Exhibit 1: Big Drops are not Uncommon

Source: Bloomberg, SEI

Data as of 2/24/2020

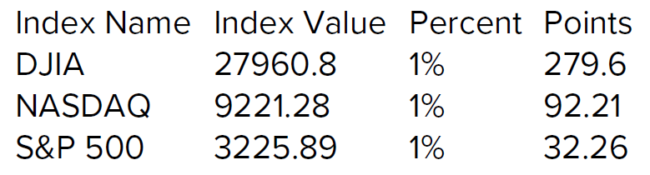

It’s also notable that the Dow’s one-year gain through February 24, 2020 is 10.0%—even with the recent drop. The same goes for the NASDAQ Composite Index (NASDAQ), where 320 points is about 3.5% and the S&P

500 Index, where 110 points is about 3.5% based on current values. (Exhibit 2). For the same one-year period, these indexes gained 23.8% and 17.8%, respectively. For comparison, the S&P 500 averaged a 13.6% annual gain over the last decade

(through February 24, 2020).

Exhibit 2: It’s the Percent (Not the Points) That Counts

Source: Bloomberg, SEI

Data as of 2/24/2020

Our View

We expect the steady flow of coronavirus-related uncertainty to cause volatility (and anxiety) to ratchet up in the near term. The angst is easy to understand. Nobody likes to see the value of their investments fall. Yet, episodes of stock-market volatility and their detrimental data have always been part of the investment landscape.

In times like these, the value of long-term planning can show its merits. While it’s human nature to want to avoid losses, the reality is that it’s extremely difficult to time markets, both to avoid losses and then to re-enter so one can reap the long-term potential gains in equities.

Now is not the time to panic. If you’re thinking about selling equities to avoid losses, it’s already too late. Further, if you do sell now, you’ll eventually have to make a decision to buy back into the market. Our research shows the decision to get back in is just as difficult to make as the decision to get out, and investors are notoriously bad at both.

Index Definitions:

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and NASDAQ.

The NASDAQ Composite Index is an unmanaged, market-capitalization weighted index that consists of all securities listed on the NASDAQ exchange.

The S&P 500 Index is a market-capitalization weighted index that consists of 500 publicly-traded large U.S. companies that are considered representative of the broad U.S. stock market.

Important Information

Index returns are for illustrative purposes only and do not represent actual investment performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice. This information is for educational purposes only. Information provided by SEI Investments Management Corporation.

There are risks involved with investing, including possible loss of principal.

This is an article originally published by SEI in February 2020 in the Knowledge Center.

If you’re considering working with us here at Mosaic, we invite you to learn more about who we serve and how we help them. You can also contact us with any questions you have.

Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.