Mind Games: 3 Investment Lessons from 2022

In the ever-changing landscape of global events and financial markets, it’s crucial to acknowledge that surprises are an inevitable part of our lives. The year 2022 brought its fair share of unexpected turns. These 3 investment lessons highlight the fallibility of expert forecasts, the inability to predict or control volatility, and the importance of our response to market fluctuations. By embracing these lessons, we can better equip ourselves to thrive amidst the surprises and uncertainties that lie ahead.

First Lesson – Surprises Happen

In 2022, we were surprised by the Russian invasion of Ukraine. We also experienced record high gas prices.

In response to persistent inflation, the Fed increased interest rates significantly. This resulted in mortgage rates doubling and both stocks and bonds experienced double-digit losses for the year.

2nd Lesson – Expert Forecasts are Notoriously Inaccurate

At the beginning of 2022, fourteen well-respected financial firms submitted their prediction for how the markets would end the year. Their forecasts for the S&P 500 Index were all over the place, some forecasting as low as 4400 to as high as 5330.1

The expert consensus estimate among several market experts was 4950.2

The market ended the year at 3840. Not. Even. Close!

3rd Lesson – We Can’t Predict nor Control Volatility

One measure of volatility is how often the markets move one percent (or more) in a day. In 2017, it only happened 8 days throughout the year. In 2022, it occurred 129 days…over 50% of all trading days. For the year.

We can’t control how volatile the future will be, but we can control how we will respond to it.

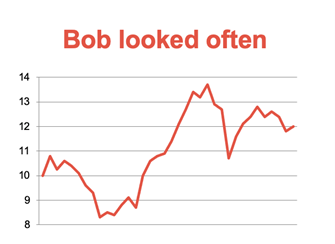

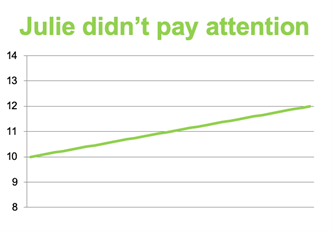

For example, let’s say Bob and Julie each purchase the same stock at $10 per share.

One year later they sell it for $12 per share. Same security, same return, but they had a totally different experience.

Bob constantly tracked the performance of his investment, experiencing all the volatility of the security. Julie never looked. She bought it and sold it. The volatility Julie experienced was significantly less than Bob.

Three Lessons to Remember in the Future

- Going forward we should expect to be surprised

- While forecasts may be alluring, they are often misleading

- Ultimately, it’s not about market volatility. It’s about how often we look and how we respond to it.

If you would like to learn more about this subject please contact us and we’ll be happy to help.

By Marcus E. Ortega, ChFC, RFC | Investment Advisor Representative | CEO of Mosaic Financial Associates & Orthopaedist Advisory Group | Securities and advisory services offered through Cetera Advisors LLC, Member FINRA/SIPC, a broker/dealer and a Registered Investment Advisor. Cetera is under separate ownership from any other named entity.

©The Behavioral Finance Network

1. Jonathan Ferro on Twitter (@Ferrotv), January 3, 2022

2. Rosenberg Research

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss.